How To Create A Budget With Gomyfinance.com: Your Ultimate Financial Planner

Creating a budget has never been easier thanks to gomyfinance.com. Whether you're a financial newbie or a seasoned money manager, this platform is here to help you take control of your finances. Imagine having all your expenses, savings, and investments in one organized place – that's exactly what gomyfinance.com offers. So, buckle up and get ready to dive into the world of smart budgeting!

Let's face it – managing money can be overwhelming. Between paying bills, saving for emergencies, and planning for vacations, it’s easy to lose track. But don’t worry, because gomyfinance.com is here to simplify your life. This platform is not just another app; it’s a powerful tool designed to help you create a budget that works for YOU.

What makes gomyfinance.com stand out? Well, it’s all about customization and ease of use. You can track every dollar you spend, categorize expenses, set realistic goals, and monitor your progress in real-time. It’s like having a personal financial advisor at your fingertips – minus the hefty price tag.

- Alice Delish Biography Asmr Social Media Discover Now

- Alexis Knief Untold Truths About Timothy Olyphants Wife

Why Gomyfinance.com is Your Go-To Budgeting Solution

When it comes to creating a budget, gomyfinance.com shines with its user-friendly interface and robust features. Let’s break down why this platform is a game-changer:

- Easy-to-use dashboard

- Customizable budget categories

- Real-time expense tracking

- Goal-setting tools

- Integration with multiple accounts

Think about it – wouldn’t it be great to have everything in one place? With gomyfinance.com, you can connect your bank accounts, credit cards, and even investment portfolios. This means no more juggling spreadsheets or trying to remember where you spent your last $50. Everything is right there, at your fingertips.

Understanding the Basics of Budgeting

Before we dive deeper into gomyfinance.com, let’s talk about the basics of budgeting. A budget is more than just a list of numbers; it’s a roadmap to financial freedom. Here’s how it works:

- Duck Dynasty Canceled Unveiling The Real Reasons Aftermath

- Knox Pitt The Facts About His Birth Life You Need To Know

You start by tracking your income and expenses. Then, you allocate funds to different categories like housing, groceries, entertainment, and savings. Sounds simple, right? But here’s the catch – sticking to your budget is where most people struggle. That’s where gomyfinance.com comes in to save the day.

How Gomyfinance.com Simplifies Budgeting

Gomyfinance.com takes the guesswork out of budgeting. Instead of manually entering every transaction, the platform automatically categorizes your expenses based on your spending habits. Plus, it sends reminders when you’re close to exceeding your limits. It’s like having a financial buddy who keeps you in check!

And let’s not forget about the reporting feature. Gomyfinance.com generates detailed reports that show you exactly where your money is going. You can see trends, identify problem areas, and make adjustments as needed. It’s all about staying informed and in control.

Creating Your First Budget on Gomyfinance.com

Ready to get started? Here’s a step-by-step guide to creating your first budget on gomyfinance.com:

- Sign up for an account: It’s quick and easy – just enter your email and create a password.

- Connect your accounts: Link your bank accounts, credit cards, and other financial institutions. Don’t worry – your data is secure.

- Set up budget categories: Customize categories that fit your lifestyle. Need a “coffee” category? Go for it!

- Set spending limits: Decide how much you want to spend in each category. Gomyfinance.com will keep you accountable.

- Track your progress: Monitor your spending in real-time and adjust as needed.

See? It’s not rocket science. With gomyfinance.com, you can create a budget that’s tailored to your needs and goals. And the best part? You don’t have to be a financial wizard to use it.

Top Features of Gomyfinance.com

Now that you know how to create a budget, let’s take a closer look at the top features of gomyfinance.com:

1. Automated Expense Tracking

No more manually entering transactions – gomyfinance.com does it for you. The platform uses advanced algorithms to categorize your expenses and keep everything organized. You can even split transactions if they fall into multiple categories. How cool is that?

2. Goal-Setting Tools

Whether you’re saving for a down payment on a house or planning a dream vacation, gomyfinance.com helps you stay focused. Set specific goals, track your progress, and celebrate your wins along the way. It’s all about motivation and accountability.

3. Customizable Alerts

Get notified when you’re close to exceeding your budget limits. You can also set alerts for bill payments, account balances, and other important financial events. It’s like having a personal assistant who keeps you on track.

How Gomyfinance.com Helps You Save Money

Saving money is one of the biggest benefits of using gomyfinance.com. By tracking your expenses and sticking to your budget, you’ll start noticing areas where you can cut back. For example, you might realize you’re spending $100 a month on dining out. With that insight, you can make adjustments and redirect those funds toward savings or debt repayment.

Gomyfinance.com also helps you identify hidden fees and unnecessary subscriptions. You know those monthly charges you forgot you signed up for? The platform flags them so you can cancel or negotiate better rates. It’s all about maximizing your money and making it work for you.

Pro Tips for Saving More with Gomyfinance.com

- Review your spending patterns regularly to spot areas for improvement.

- Set realistic savings goals and track your progress.

- Use the platform’s reporting feature to analyze your financial habits.

Remember, saving money is a journey. With gomyfinance.com, you have the tools you need to make smarter financial decisions and build a brighter future.

Common Budgeting Mistakes to Avoid

Even with the help of gomyfinance.com, it’s easy to fall into common budgeting traps. Here are a few to watch out for:

- Setting unrealistic goals – Make sure your budget reflects your actual income and expenses.

- Ignoring irregular expenses – Don’t forget about things like car repairs, medical bills, and holiday gifts.

- Not tracking cash transactions – Every dollar counts, so make sure to log those cash purchases.

Gomyfinance.com can help you avoid these pitfalls by providing reminders, alerts, and detailed reports. It’s like having a financial safety net to catch you when things get tough.

Testimonials from Gomyfinance.com Users

Don’t just take our word for it – here’s what real users have to say about gomyfinance.com:

“I used to dread budgeting, but gomyfinance.com has completely changed my perspective. It’s so easy to use, and I love the automated features. I’ve saved hundreds of dollars already!” – Sarah, 28

“As a small business owner, managing finances can be overwhelming. Gomyfinance.com has simplified the process and given me peace of mind. Highly recommend!” – John, 35

These testimonials speak volumes about the platform’s effectiveness. Whether you’re a student, parent, or entrepreneur, gomyfinance.com has something to offer everyone.

Final Thoughts on Gomyfinance.com Create Budget

In conclusion, gomyfinance.com is more than just a budgeting tool – it’s a financial game-changer. By helping you track expenses, set goals, and save money, the platform empowers you to take control of your financial future. And with its user-friendly interface and robust features, it’s accessible to everyone, regardless of their financial expertise.

So, what are you waiting for? Head over to gomyfinance.com and start creating your budget today. Don’t forget to share your experience in the comments below and check out our other articles for more financial tips and tricks.

Table of Contents

- Why Gomyfinance.com is Your Go-To Budgeting Solution

- Understanding the Basics of Budgeting

- How Gomyfinance.com Simplifies Budgeting

- Creating Your First Budget on Gomyfinance.com

- Top Features of Gomyfinance.com

- How Gomyfinance.com Helps You Save Money

- Common Budgeting Mistakes to Avoid

- Testimonials from Gomyfinance.com Users

- Final Thoughts on Gomyfinance.com Create Budget

- Gold Rushs Rick Ness Who Is He Dating Now Details Engagement

- Explore Reddi Bass Dired Music Tech Insights

Weekly Budget Planner Template, Weekly Budget Sheets, Weekly Bill

Budget Visuals FREE Infographic Maker

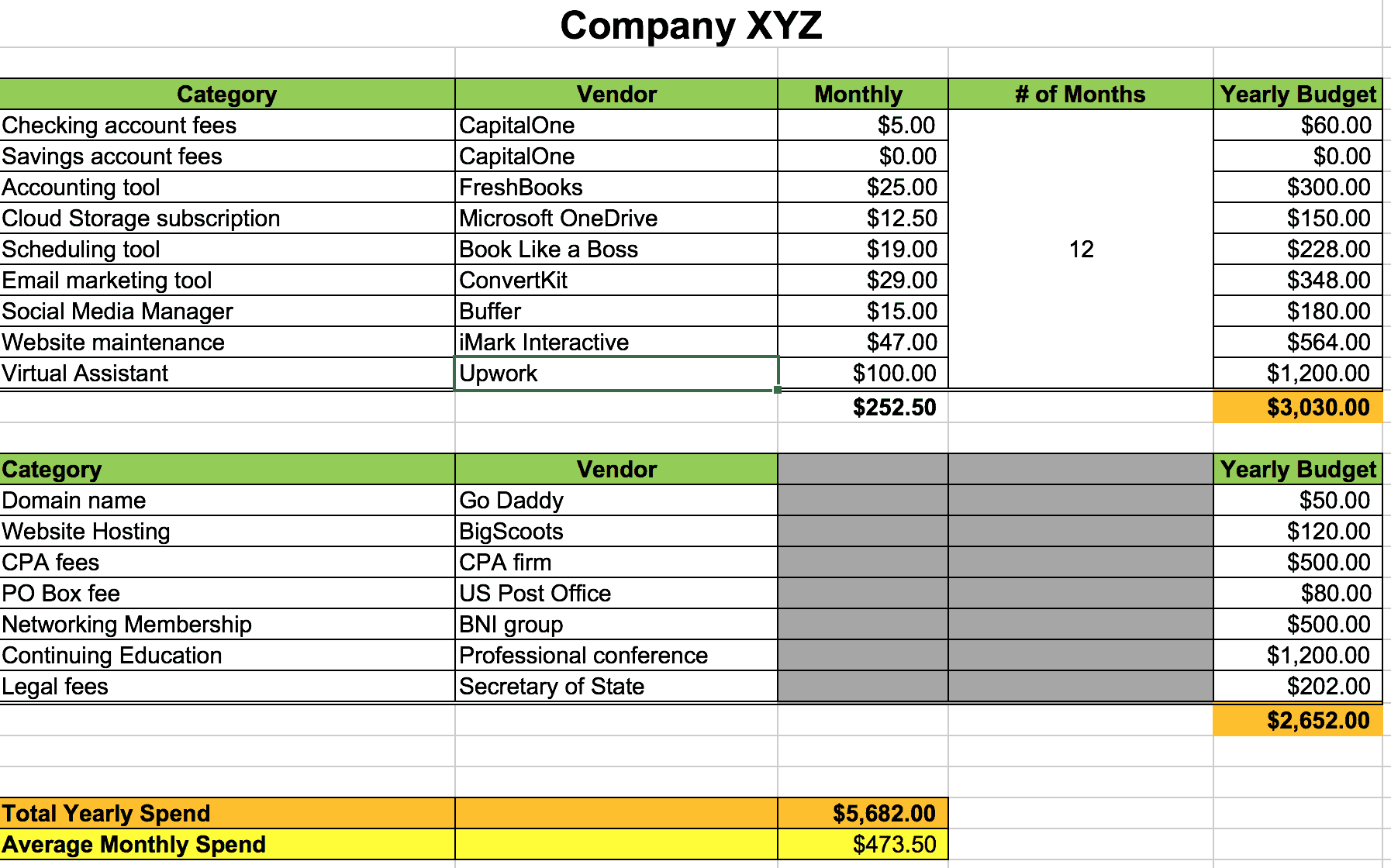

How to Create a Business Budget SMI Financial Coaching